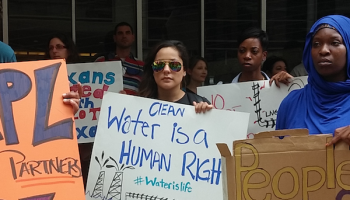

We believe in a just climate future where everyone has the right to breathe clean air, drink clean water, and live in safe, healthy homes with access to good schools, jobs, and healthcare.

For far too long, inequitable, unjust systems have perpetuated disproportionate impacts across low-income communities and communities of color, plaguing them with dirtier air and water and worse outcomes from extreme weather.

A just climate future relies on affordable, reliable, and renewable clean energy for everyone. 100% clean energy is achievable and necessary for resilient, healthy communities. Clean, climate-sustaining energy will protect the health of our communities by reducing pollution from dirty energy sources and ensuring a healthy, liveable future.

We can reduce consumer costs by transitioning to affordable, reliable, renewable energy (which is cheaper than coal and natural gas.) Cleaner electric vehicles and fuels reduce our dependence on fossil fuels for transportation and save consumers money while reducing waste.

We can create thousands of good-paying jobs building clean energy technologies and batteries and weatherizing our homes and businesses to make them more energy efficient.

A Brighter Future is Possible

The Biden Administration passed the most ambitious climate plan in history, which will cut approximately 1 billion tons of carbon pollution by 2030.

In addition to the federal climate laws, Michigan passed its own historic Clean Energy and Climate Action package of bills, pushing Michigan to the frontlines of US climate action by setting the goal of 100% clean energy by 2040.

President Biden’s climate plan will triple the production of clean energy, which will make it more affordable for families and is projected to save Americans $38 billion on their electricity bills. The plan also cracks down on price gouging and profiteering by Big Oil and Gas companies.

Since the laws passage, over 20,000 clean energy jobs have been created in Michigan alone, and the total number of national jobs created has surpassed 300,000!

Clean energy and climate action brings more jobs, a stronger local economy, and a better future for our kids.

Save Money on Renewable Clean Energy through Tax Rebates

Find out how much you could save at your home through energy updates and improvements with Rewiring America’s Energy Saving Calculator.

Go Solar

What the Residential Clean Energy Tax Credit covers: You’ll get 30 percent back on what you pay for new household clean energy systems—like solar, wind, or geothermal systems that produce electricity or heating—as well as the labor to install them and the fees for permitting, inspection, and development. It also covers the purchase of stand-alone batteries with more than 3 kilowatt-hours of storage. There is no cap on the total spent. So spend $5,000 or $50,000 and still get a 30 percent tax credit. If you don’t owe that much in federal taxes, the remainder of the credit rolls over into the next tax year.

Go Electric

What the EV tax credit covers: The law renewed the $7,500 Clean Vehicle Credit for new electric vehicles, which was set to expire at the end of 2022. It also added a 30 percent tax credit (capped at $4,000) for used electric vehicles. Great news for families on a budget. Starting in 2024, you can transfer these credits to a dealer, which allows for a point-of-sale discount rather than waiting until tax season. And if you need to install an EV charger at home, the Inflation Reduction Act renews a recently expired tax credit that covers 30 percent of the cost.

But there are some new requirements specifically for new cars. In an effort to boost domestic EV and battery production, this tax credit was amended in a few ways. All eligible vehicles now have to satisfy a requirement for final assembly in North America. Additional changes around critical mineral and battery sourcing requirements are also now in effect. (Vehicles that only meet half of these new sourcing requirements will still be eligible for $3,750 of the tax credit.) But since not all EV manufacturers have the supply chains to comply with these provisions just yet, there’s going to be a temporary dip in the number of qualifying vehicles while automakers and downstream supply chains scale up U.S. production. Check on a specific vehicle’s eligibility through the U.S. Department of Energy’s website, which has a searchable database of qualifying vehicles.

Go Energy Efficient

What the Energy Efficient Home Improvement Tax Credit covers: Recently expired, this credit is getting a renewal and a big upgrade. Compared to the previous $500 lifetime max, consumers can now get 30 percent back, up to $1,200 per year, for energy-saving renovations like adding insulation or swapping out exterior windows that better keep cool air out in the winter and inside in the summer. It also incentivizes the purchase of certain electric, energy-efficient appliances, like heaters, AC units, and boilers. It ups the annual credit cap to $2,000 per year for items like über-efficient heat pump air conditioners, heat pump water heaters, and boilers. If you’re unsure which changes to make, the new law also offers a $150 tax credit per household for a home energy audit.

What these rebate programs cover: The HOMES (Home Owner Managing Energy Savings) Rebate Program gets you cash back by shrinking your overall home energy use through weatherization renovations, like adding insulation, or by installing more efficient appliances, like heat pump clothes dryers. The amount you can get back depends on how much energy you’ve saved, how you prove those energy savings (through either modeling, which requires computer software, or measured energy savings), and your household income. Save more energy, get more cash. Plus, low- and moderate-income households qualify for double the rebate amount and are eligible for up to 80 percent of project costs. That’s $8,000 max if you cut energy use by 35 percent and $4,000 max if you cut energy use by 20 percent.

The “High-Efficiency Electric Home Rebate Act” (HEEHRA) offers low- to medium-income families as much as $14,000 per year in point-of-sale discounts for electrification projects—including up to $8,000 for a heat pump for space heating and cooling, $840 for an electric stove, and $1,600 for an insulation project.

What makes our new climate laws so significant?

The Inflation Reduction Act and Infrastructure Investment and Jobs Act provides game-changing financial incentives for communities, individuals, and industries to expedite the clean energy transition.

The laws recognize three obstacles to solving the climate crisis and provide solutions for all of them:

- They recognize that the clean energy transition needs to take place at an unprecedented pace, and the adoption of new technologies needs financial support to scale fast enough.

- They recognize that the impacts of the climate crisis fall disproportionately on BIPOC and low-income communities and that those communities have historically received fewer public resources.

- They recognize that the climate solutions have often disadvantaged domestic companies and US workers, undermining support for them and threatening the US economy.

The clean energy transition will do more than help solve climate change, as important as that is. It will also clear the air of fossil fuel pollution – from vehicles, power plants, and other sources – saving hundreds of thousands of lives in the US and improving the health of millions of people.

The laws have an unprecedented focus on environmental justice. Before their passage, the US clean energy transition was almost exclusively available to affluent consumers, early tech adopters, and niche businesses. To address this, the IRA and IIJA require that 40% of their program benefits go to “disadvantaged” communities through the Justice40 directive. The impact of Justice40 will be very significant in many Michigan communities.

Previously, the clean energy transition threatened US energy industry workers and businesses with low-cost technology produced in countries with weak labor and environmental standards. However, the IRA and IIJA provide explicit direction to use the domestic supply chain. Given the importance of manufacturing industries in our state, these laws will be very significant in Michigan. They will promote high-paying jobs and possibly union jobs.

We recognize that these laws are only the first step. The transformative change they make possible relies on widespread action and public support. The Ecology Center and our partners are working to build the needed public support and awareness so that the progressive change materializes into substance that demonstrates the impact these new laws create in our lives.